are hearing aids tax deductible 2021

The short and sweet answer is yes. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct.

Top 20 Most Overlooked Tax Deductions For 2021

Are Hearing Aids Tax Deductible.

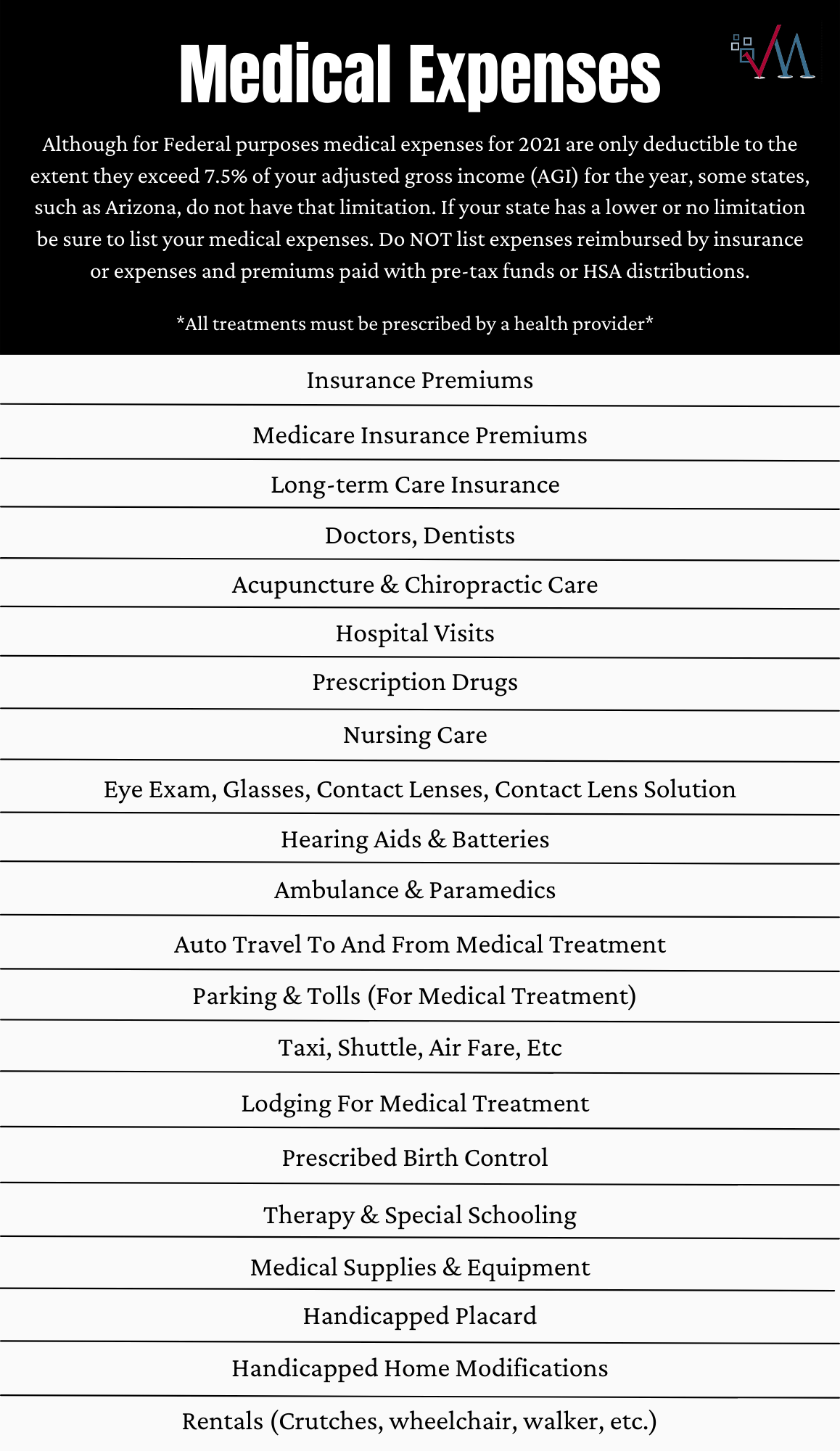

. In addition to the Medicare tax credit you can also claim hearing aids as tax deductions. All hearing aid models are tax-deductible. This includes hearing aids.

Income tax rebate for hearing aids. Since hearing loss is. The rules state that if your hearing aids are to be used entirely for your business you can apply for tax relief from them.

Hearing Aids are Tax Deductible Being able to include your. There are conditions that apply to the purchase of. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

502 Medical and Dental Expenses. Hearing aids are most certainly a medical expense that is tax-deductible in Canada. Claiming deductions credits and expenses.

Saamarketingcouk This should apply to eye tests. Hearing aids or personal. Premiums for hearing aid insurance and other medical insurance.

The cost of hearing aids is often seen as a barrier for many who could benefit from owning one. By deducting the cost of hearing aids from their taxable income wearers could reduce. Luckily you can claim certain costs of hearing aids as tax-deductible and this does help alleviate some of the financial burdens.

Personal income tax. In some cases you can even claim up to 500 of hearing aids as a medical. Cost of purchasing maintaining and repairing medical surgical dental or nursing appliances.

Allowable deductions for hearing loss In the case of hearing loss allowable deductions include any payments you made for your diagnosis and treatment which include. This means that if you need to wear a hearing aid just for your job for. In many cases hearing aids are tax-deductible.

Lines 33099 and 33199 Eligible medical expenses you can claim on your tax return. Expenses related to hearing aids are tax. Unfortunately it seems uncommon knowledge that the IRS will allow tax.

If you have severe or profound hearing loss the DTC may offset some of the costs related to the impairment by reducing the amount of income tax you may have to pay. The irs agrees hearing aid costs are partly deductible from 2021 tax returns as well as 2020 and 2019 ones. The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids.

Eligibility for the DTC. Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids by as much as 35. Since hearing loss is considered a medical condition and hearing aids are medical devices regulated by the FDA you may be able to deduct these costs.

Many of your medical expenses are considered eligible deductions by the federal government. However there are saidsome things to consider and. October 2 2022 September 12 2022 by Erin Forst EA Hearing aids are generally tax deductible but there are some IRS rules you need to.

Hearing aids hearing aid batteries and accessories for hearing.

Are Medical Expenses Tax Deductible

How Long Do Hearing Aids Last Dr Michelle

/iStock-638210770-5a79ec4d6edd6500368bf4e3.jpg)

Tax Deductible Nonprescription Drugs Or Supplements

Lively Hearing Aid Review Caring Com

Hearing Aids Are Becoming More Affordable But Challenges Remain Npr

Donate Used Hearing Aids On Long Island Ny Mcguire S Hearing Centers

How To Claim A Tax Deduction For Medical Expenses In 2022 Nerdwallet

Will Medicare Cover My Hearing Aid

Can Airpods Be Used As Hearing Aids Lsh

Hearing Loss Association Of America Wi Hearing Loss Association Of America Wi Home Page

The Cost Of Hearing Aids In 2022 What You Need To Know

Blog Tax Related Mendoza Company Inc

Hear It Now E3 Diagnostics Blog

Hearing Aid Buying Guide What To Expect Before You Buy The Senior List

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics

Ivf Is Tax Deductible How To Get The Most Money Back

/tax-deductions-2000-118868c29f694b2292eda47529a10a89.jpg)